Pre-payment signature verification that transfers accountability to recipients. Stop £50K fraud losses per incident.

Trusted by enterprises managing 180,000+ employees

Ghost employees go undetected for 18 months on average. Traditional payroll systems rely on trust—creating blind spots that cost £50,000 per incident. Your finance team can't catch what they can't see.

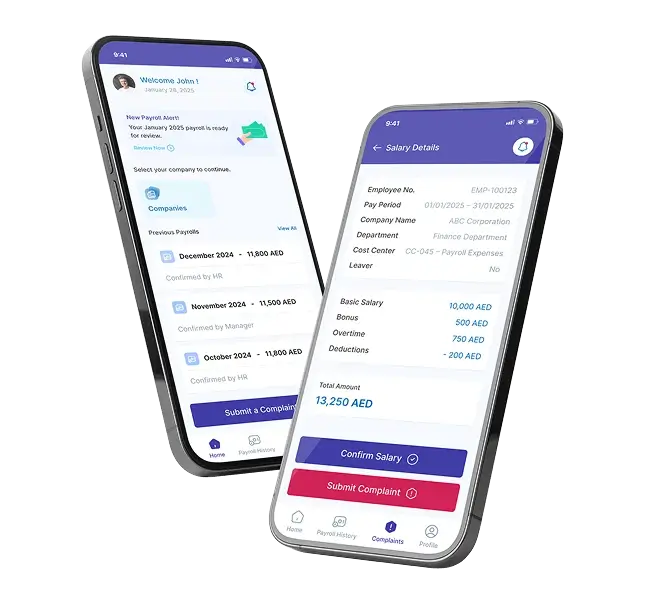

PayrollAI requires digital signature confirmation from every recipient before funds transfer. Ghost employees become impossible. Disputes disappear. Audit trails are immutable.

Revolutionary: Every employee/vendor signs digitally before payment, eliminating ghost employees and transferring verification responsibility.

Real-time analytics flag duplicate payments, anomalies, and suspicious patterns before money leaves your account.

100+ languages supported. Instant, policy-accurate answers to payroll queries. Cut HR workload by 60%.

During ransomware attacks or system failures, payroll continues uninterrupted. Your team keeps working when others shut down.

Every transaction logged with digital signatures. Regulatory-ready reporting at the click of a button.

Seamless CRM/ERP integration. Scales from 10 to 1 million+ employees. Zero infrastructure changes required.

Trusted by enterprises managing 180,000+ employees. Join CFOs eliminating fraud and achieving audit compliance.

15-minute consultation with implementation roadmap and ROI analysis